T-a-r-i-f-efffffff

But in fact there are *even worse words* than that when it comes to destroying all confidence in spending money...

Can a single word, standing alone, directly impact whether a person will or will not spend money? If not, this newsletter is effed.

To help us answer that question, consider this early draft of a headline for a 1960s print ad:

This one missed the boat.

The far-too-unknown copywriter Rita Selden, of DDB, took one look at that headline, scrawled on paper and pinned next to a car photograph on an artroom corkboard, and said: Why don’t you just say “Lemon”? Et voila. That begat / begot / begettered the most iconic ad headline of all time:

One word.

However, that one word didn’t stand alone. It was sandwiched between 1000 words (i.e., a picture) and about 100 words (i.e., the body copy for the VW ad). And it was packed with meaning. The word “lemon” in the context of the Lemon ad told a big story in five little characters.

Lemon wasn’t just a good ad, from a thinky-creative-person perspective. It also sold a lot of cars.

Together with VW’s Think Small ads, the Lemon ad changed consumer perception of the VW brand in the US. It established VW globally. And more interestingly for our purposes here at Money Words, it helped VW go from 29,000 annual sales in 1960 to more than 400,000 annual sales in 1968, a CAGR of 22.37%. The Beetle became the first import car to achieve mass-market success in America. And that was at a time when heavy tariffs plus incentives for dealers to sell domestic meant an American had to really, really, really, really, really, REALLY want a VW in order to buy one.

But the word “lemon” didn’t make anyone buy a VW. So:

Can a single word, standing alone, directly impact whether a person will or will not spend money?

Words never actually stand alone. They appear in context. And they’re packed with meaning - meaning that goes way back to the very origins of the word. For example, let’s pretend you’re a college student taking Latin because you love wasting your money. You’re bored on the busride to campus, so you flip open your Latin dictionary and look up, obviously, the word “penis.” As a student of Latin, you know “penis” looks like a Latin word (third declension noun, nerd). What does the Latin word penis mean in English?

Answer:

Penis.

Fascinating. Penis means penis. Okay, so same must be true for the word “vagina,” right? The Latin word “vagina” means “vagina”? You look it up, and you find it means:

Sheath.

Hmm. So way back in Ancient Rome, you’re a woman walking around, trying to get, y’know, basic human rights and stuff. And your genitalia is synonymous with the thing that a sword gets - ahem - jammed into. Dude gets his very own penis word. Your stuff gets to be, well, not your own thing at all. Cool. Great. The vote must be right around the corner!

And those are just two words. And they go so far back, it’s hard to imagine that they’re laden with any of the meaning our Latin student just spotted. But they absolutely have baked-in meaning. Some words have history, like grandfathered and master. Some have too many meanings and, as such, require context:

Get

Shot

Set

Felt

Some words are their own opposite, like cleave and oversight, which is a language oversight that could cleave your brain right down the center.

Basically, we always need context. And context is often baked into a word. So no word actually stands alone. (Does it? Do you know one??) We rephrase:

Can a single word directly impact whether a person will or will not spend money?

Late last week, Noahpinion showed the near-instant impact of Trump’s tariffs on the stock market and economic uncertainty. As in, the stock prices were dropping at the very same time - and on the very same screen - that Trump announced tariffs.

Say “tariff” → kill spending

It’s not the first time the word “tariffs” in the media has had negative consequences in real life. Those who had a better history teacher than I did know of the Smoot-Hawley Tariff Act of 1930, which was widely covered by media in 1929 and which, after the act was passed, actively worsened the Great Depression.

The tariff act shrunk US exports by >60% between 1929 and 1933.

The tariff act triggered foreign tariff retaliation, which hurt American business.

The media pointed to the Smoot-Hawley tariffs as a key factor driving the banking crisis of 1931.

Importantly though… the word “tariff” is tariffying because tariffs are shit economic practice. Introducing tariffs signals that the world is about to go to hell so everyone rein in your spending - it’s about to get rocky.

Say “tariff” → kill spending

Of course, the concept of a tariff is the thing that kills spending. Not the word “tariff.” Obviously, right? But did you know that there are actual words and phrases that, when uttered, immediately killed spending?

This study, among others, found that news sentiment is a powerful predictor of market moves, and negative language in the media often has a stronger impact on the market than positive language.

5 phrases that, historically, instantly closed wallets, slammed bank vault doors and nearly tanked the world as we knew it

In December of 1996, while I was scrounging up two hundred bucks to stand center-stage (tenth freaking row!) so I could see Bono step out of a lemon, U.S. Federal Reserve Chairman Alan Greenspan uttered this phrase after hours:

Irrational exuberance.

Immediately, Japan’s Nikkei index plunged by ~3%. When the US market opened the next morning, US stock futures fell. Today, “irrational exuberance” is an anti-money word that signals stocks are overvalued, which quickly chills investors.

Something similar happened in 2013, but lean in because I have to whisper this one or it could set off another mad global tantrum with locusts and frogs and everything…

Taper.

On May 22, 2013, Chair of the Federal Reserve Ben Bernanke told Congress they were going to taper stimulus spending, which immediately caused panic. The S&P 500 dropped 8% over the next few weeks. The more the word “taper” appeared in public discourse - specifically across mainstream media - the worse economic panic got. Journalists dubbed it a “taper tantrum” as world equity indices fell 10% and investors dumped US bonds.

According to this, the data shows a clear causation chain:

Bernanke mentions taper 👉 the media keep saying it 👉 stock prices keep tanking

Today, you simply do not say the word “taper” when discussing winding down stimulus. And while we’re on the subject, tapered pants are also out.

Pandemic.

On March 11, 2020, the WHO announced COVID-19 as a global pandemic, the S&P 500 fell 4.9% and the Dow Jones fell 5.9%.

Recession.

On December 1, 2008, the official use of the word “recession” in headlines caused the S&P 500 to drop by nearly 9% immediately. The Dow Jones dropped by 679 points, one of its worst single-day falls… at the time. On August 14, 2019, media outlets blared warnings of a potential recession, and the Dow dropped 800 points in one day. Silver lining: a new record was set for the Dow!

And finally…

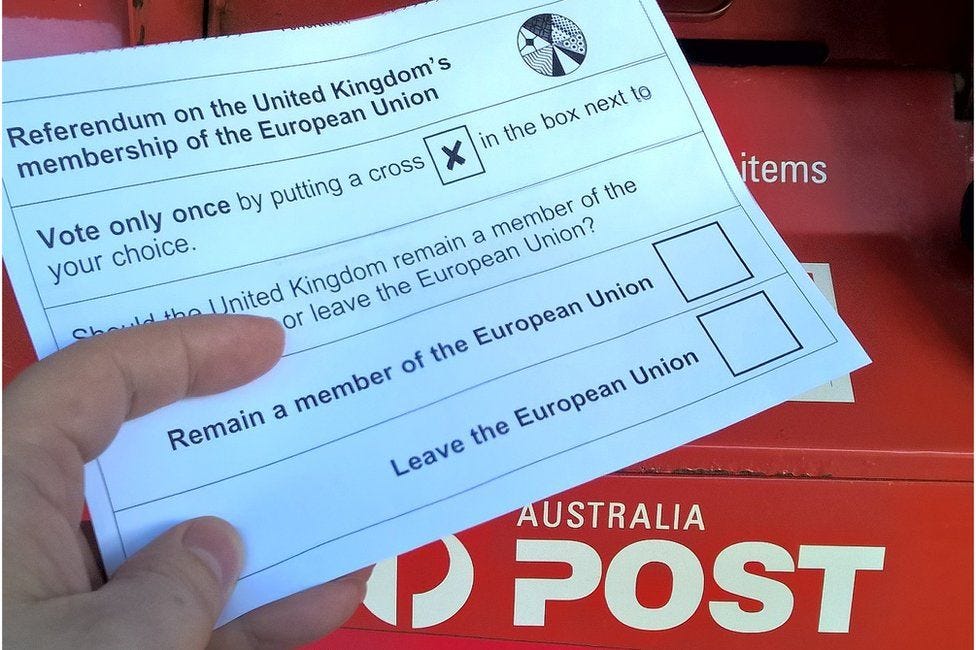

Leave.

When asked if they would remain or leave, Britain said they’d leave the European Union. The next day, global equity markets lost $2,000,000,000,000 (that’s two trillion dollars) in value, the S&P fell nearly 4% and the Dow Jones dropped 3.4%. Stock indexes in Spain and Italy dropped over 12%. Nikkei dropped nearly 8%. No one was spared when Britain left.

If you don’t want to tank spending, avoid publishing these words and phrases:

tariffs

irrational exuberance

taper ← could be a safe word in the right context, but it’s got bad vibes now

pandemic

recession

leave

Side note: we need to have a conversation about how dull finance-guy language is and how the boredom it induces - dare I say intentionally? - separates most of us from more money.

~jo :)

PS: What is an irrational fear of complicated clusters of buildings?

A complex complex complex.